Competitive research should be part of all marketing programs and is especially important in the ever-changing and highly competitive world of PPC, but how do you get started? Below we will discuss how to create a plan, what tools are available and how often to perform PPC competitive research.

You all know this person “Let’s just see what the competition is doing and copy it”. Is this you or sound like someone you know? It’s okay, be honest. First step is admitting the problem. It seems like a quick easy win, right? Not necessarily. Just because your competitor is doing it, doesn’t mean it’s right for your business. Without having all the data, just blindly copying the competition can be dangerous and cost you more in the end. In order to strategically perform PPC competitive research and analysis, let’s start with the first tip – creating a plan.

1. Create A Strategic Competitive Research & Analysis Plan

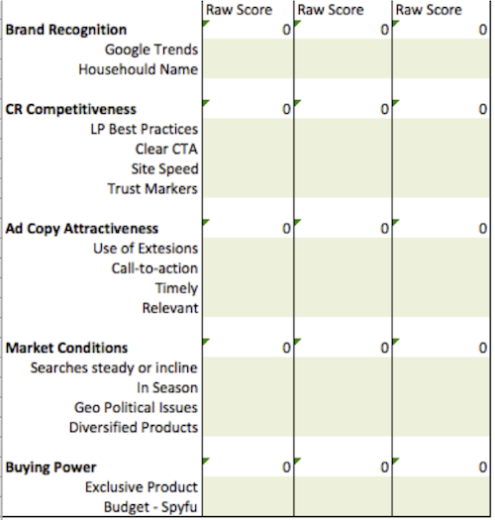

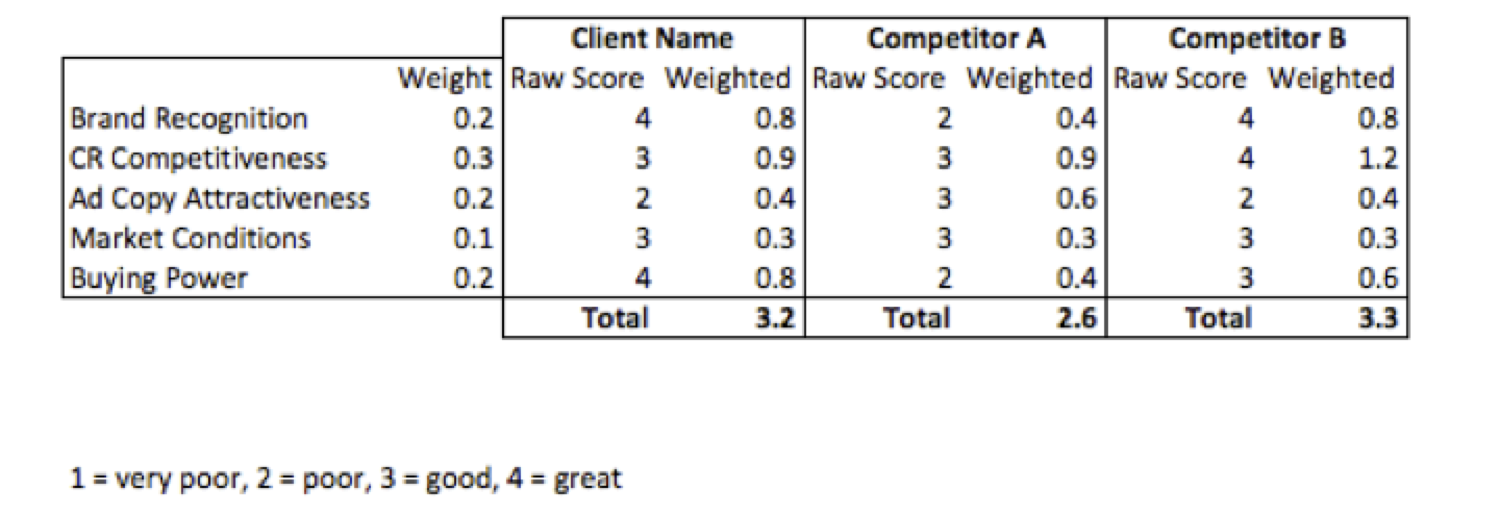

With most things we do at Hanapin, we like to have a plan of action for how we are going to approach an analysis. Below is an example of a template that we use that allows us to understand how our clients compare to their competition and help identify their strengths and weakness in the online advertising space.

For this process we select two competitors and score the client vs. their competitors on the key areas listed below on a scale of 1-4:

- Brand Recognition

- CR Competitiveness

- Ad Copy Attractiveness

- Marketing Conditions

- Buying Power

Once you’ve completed the analysis, you then tally up the scores and weight them based on key areas that are most important to the client.

2. Get Cozy With Competitive Research Tools.

There are many free and paid competitive research tools available. Fellow blogger, Sgt. Kayla Kurtz, earlier this year wrote an article that covered in depth competitive research tools that you can find here. The data provided by the various tools will vary, so I wouldn’t live or die by these numbers, but more or less use them as a benchmark for future planning. Below is a quick re-cap of some of the tools available.

Competitive Research Tools:

- AdWords Auction Insight Tool – Located directly in your AdWords account is the free Auction Insight Tool. This free option will show you what % of impression share you have in the AdWords search auction compared to other competitors in your space. This is a handy tool for a quick glance but does not show the actual ads.

- AdWords Preview & Diagnostic Tool – This tool is great to see if your own ads are showing up without skewing impressions, or to spy on competitor’s ad copy in various geographic regions.

- Spyfu.com – This is a pretty sweet free tool that I use often. The free version of Spyfu provides some insight into what competitors are spending; last time they’ve updated their ad copy and the actual ad copy. Spyfu data is only limited to AdWords in the US and UK. Spyfu also offers a paid version, which offers about 90% more information.

- SEMrush.com – SEMrush is very similar to Spyfu except for the fact that you can view AdWords and Bing information. SEMrush offers more geographical coverage including: US, UK, CA, RU, DE, FR, ES, IT, BR, AU.

- Adgooroo – This tool, in my opinion, is by far the most complex of all the competitive research tools listed above but is not a free tool. Adgooroo offers reporting on Industry Insight, PPC vs. Organic, Trademark Information and much more. If you want to do some extensive research regarding a specific industry, or want to track to see if affiliates are bidding on your brand terms, this tool may be a better option for you.

3. When To Do Competitive Research

This really does vary on the vertical or account but as long as you are thinking about it, and plan to do competitive research, you are already moving in the right direction. Below are some recommendations on when you should consider doing some competitive research.

- New to an Account or Company – Get familiar right away with competition. See how the account compares to competitors in the online space and use this info to bring some fresh ideas to the table.

- Seasonal Trends & Peak Seasons – Check-in to see what offers your competitors are promoting and make sure your ads and offerings are better. Holiday season is right around the corner so this would be a good time to start planning and researching competition!

- Quarterly Business Review – If your account is pretty stable and not affected as much by seasonal trends, checking in quarterly is probably a good rule of thumb. This allows you to review and plan for the upcoming quarter’s creative strategy.

In conclusion, competitive research should be a part of every PPC marketing strategy and there are many free and paid options available out there to do this. Get started by creating a strategic plan, get familiar with the competitive research tools and put it on your calendar to check in on competitors regularly. Hopefully the three tips listed above will help provide you with a foundation to get started with your PPC competitive research and analysis.