This week, the PPC Hero series team has been uncovering various ways PPC numbers may be slightly skewed or just downright inaccurate (AdWords vs. Analytics data, Google Display placements, etc.). But how can misreported data hurt you from a competitive research standpoint?

Competitor research is a portion of account management that must be taken seriously and revisited often, especially in highly competitive markets. Obviously none of us have the ability to look directly into a competitors paid search account and decide conclusively what they’re up to, but there are various tools out to assist in getting a ballpark idea. Therein lies the point: ballpark, indeed. We’ll get to that.

Some of the more popular competitor research tools are SpyFu, SEMRush, iSpionage and there are quite a few more out there. Most of these tools give you similar information about competitor budgets, traffic volume, average ad positions, sample ad text and so on. To be honest, I’ve learned to use the three called out above most often, but there are paid versions of those, as well as other paid services, that offer much more detailed information to subscribers.

The truth is this: these tools are, very much so, for estimations purposes and should not be taken as direct reports of competitor activity. The variation between fact and what you see, however, is the trickiest part. How do you decide what to go off of? How can you know if the estimations are even close?

My first experience with this came in doing competitor research for an account I adopted at Hanapin in my first 6 months doing account management. The client had been with the agency for a number of years, but since I was taking over I decided I could get more familiar with the vertical and perhaps find some quick wins based on completing some competitor research. I used a couple of my favorite competitive PPC research sites and rather quickly realized I could be basing my competitive strategy on highly misleading information. How did I figure that out? Well I plugged my client’s account in the tools and guess what…the data wasn’t very accurate to real-life and I knew that for a fact because (obvi) I could see my client’s account and the ACTUAL data. Let me show you what I mean…

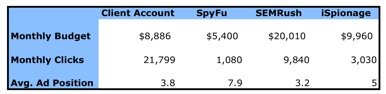

Here’s a chart showing my client’s account data compared to the information reported from 3 other competitive research tools (client account data based on the full month of September):

It’s fairly easy to see the discrepancy between my actual account’s data and what the various tools are reporting. So that’s one part of it…why are the numbers off by so much? Even where one of the tools may be getting close (i.e. iSpionage’s budget report isn’t off by a terribly large amount), they only get that close for one of the metrics and then give vastly different estimations for other segments of account data (again, looking at iSpionage, close on budget, but only showing about 7% of my click volume).

What irks me about this data being so skewed from actual account performance is the way each one says “yes, these are estimations” but then follows by saying they pull their data in real-time and it’s as accurate as competitor data can be. Clearly not, right? And could you pick one? Are these estimations or real-time, accurate metrics?

Even more, if we as account managers are capable of utilizing these tools, what happens if our client checks them too and thinks we’re not keeping up with the competition?

The answer to dealing with the misleading competitor information is to give it the treatment it deserves: realize none of these tools have direct access to account information and that their algorithms for data collection are incapable of breaching accounts in such a way to provide more than vague looks at who else is in your marketplace.

So am I saying to ignore the data altogether? Definitely not! The other reason I showed data from 3 different tools is because my tactic with the specific metrics is to average them out. Granted, even using this method the numbers aren’t quite what they seem (i.e. the averaged budget between those three puts me at around $11k/month), but it gives you a better shot at an accurate estimate than just looking at one and running with it.

I also still find these tools very helpful in terms of checking out competitor ad copy. It can be difficult to compare and contrast how accurate the reported copy is to actual ads your competitors are running (generally you can only see ad copy from months previous, which could no longer be active), but you can get an idea for value/benefit statements, whether they’re quoting price or leaving it out, etc. You can also see if there’s a new competitor creeping in to your ‘Top Competitor’ reports and look them up on your own.

The bottom line is to always remember you’re looking at estimations of everything your competitors may be doing and don’t take any one source’s word for it.

What do you think? Are you using these, or similar, competitor research tools for your accounts? Do you see data that is highly inaccurate in it’s estimations and did it change your account management strategies (either good or bad)? Share your thoughts, ideas and experiences with us in the comments section below!