PPC Hero is a great resource for PPC newbs and PPC vets alike. We throw around a lot of lingo and acronyms, as well as methods and strategies that may be uncharted to some you.

Day-parting is a perfect example of a common piece of analysis used by PPC Heroes everywhere that requires an extra step in how you evaluate your data.

What is day-parting? This refers to the segmentation of performance by day-of-the-week or hour-of-the-day. We often look to these data for insights about the where we can cut back ineffective spend or push harder on what’s working. Here we’ll look at what deductions can be made from the hour-of-the-day data.

The 3 ways we’ll investigate the value of day-parting analysis are 1) General traffic trends 2) User behavior and 3) Industry share analysis and where you rank.

1) General traffic: This refers to the trends in overall attributes of your account. What are consistent cycles that can be seen based on just data?

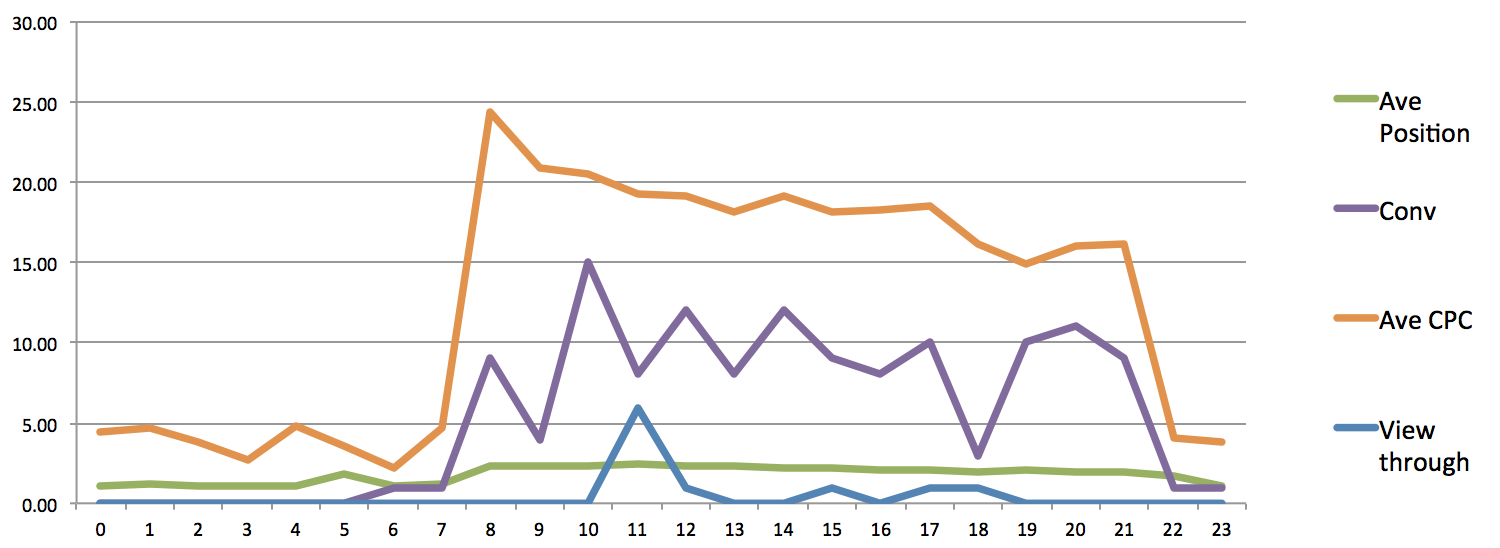

To begin, we always start with pulling campaign performance data, segmented by hour of the day. We them put these numbers into a pivot table so that we can see our metrics for each hour. Which metrics to use? Glad you asked. For this analysis, I’ve included Average Position, Conversions, Average CPC, and View Through Conversions.

Note: VTCs are a touchy topic. Our very own Sean Quadlin, who will be speaking at SMX East I might add, just provided an insightful post about this very topic. Feel free to visit the link and share your thoughts, too!

Looking at my data, I can make these general observations:

- Average position is at its lowest during business hours, and then improves in the “off-hours.” This is pretty standard behavior for an industry that operates heavily through phone calls. But what we also see is that the fluctuation of my rank is not significant between hours of operation. Slight slump around 5am, but generally smooth sailing.

- Conversion volume certainly has peak times of day, with the highest point being mid-morning. As I evaluate the quality of these leads, I may opt to bid more for the time of day when I see increased leads. Similarly, there’s a crazy drop in conversion volume around the dinner hour before regular page is resumed. Then as our users drift off to slumberland around 10pm, our conversion volume plummets to a solid zero.

- Average CPC is a metric I want to carefully watch, as my position and conversion volume are both tied in closely to these estimates. The orange line on the graph gives a pretty clear depiction of the spike my account sees each morning around 8am. Even more noteworthy is the fact that from 7am to 8am the average CPC increased by over 4x before slowly reducing over the course of the day. As I evaluate my bids, I may want to put more emphasis on the time of day when I’m actually bringing in better conversions and pull back at times with lower activity. As you can see, I’ve already got my evening reduced by quite a bit as to minimize the non-converting traffic.

DECISIONS BASED ON THESE DATA:

Looking at this chart and the figures that accompany it, my biggest takeaway is the large conversion volume mid-morning. I want to be sure I am bringing in qualified leads for this range and paying an affordable CPL, too. (If they’re way too expensive, I’m going to need to back off. The CPL matrix will help me make this call)

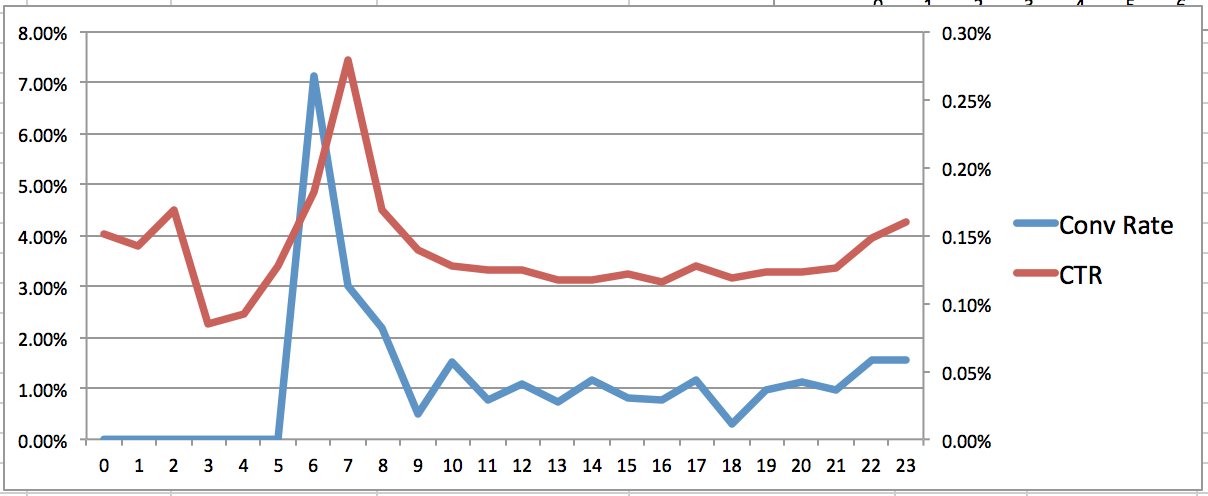

2) User behavior: Here we’re looking at users connecting the dots between seeing an ad, clicking, and converting as the day rolls along. The metrics I’ve pulled for this analysis revolve around click-through-rate and conversion-rate. It also couples nicely with the general analysis we just went through.

- Looking at CTR through an hourly breakdown gives us a great sample of when our users are most active in their searching. As previously noted, the early day tends to be heavier with clicks and with conversions. The graph depicts a strong surge in clicks around 7am and a tapering around 9am. As the day wraps, we see a slight lift in CTR. My immediate thought from these data? I need to make sure my CPC and my budget can handle these swings in activity. Am I set to standard delivery or accelerated? Accelerated may, as they warn, blow through my daily budget pretty quickly. But if I’m bringing in my best traffic at this time, doesn’t it seem like the ol’ iron’s hot in the morning?

- Conversion rate is what will convince me to act. Conversion rate tells me that the highest ratio of clicks to leads coming first thing in the morning. While our previous graph suggested that the cost-per-click is going to be pricier at this time of day, I can see from this graph that if an early-day user clicks between 5am-7am, they’ve got a good chance of converting. Sure, this might be a generalization that requires more investigation on the campaign level (for brevity’s sake, we’ve skirted the discussion of campaign type: Branded, Search, Display, Remarketing).

DECISIONS BASED ON THESE DATA:

I want conversions. And I want them for cheap. Based on the data in this graph, my best strategy is to go into the time with the highest conversion rate and ensure that my position is at its best and my clicks are affordable. I also can see where my CTR is high without lead volume to justify my investment. Here I would actually look into my Remarketing campaign to see if those clicks are worth the tagging of visitors. If I can see that my Remarketing campaign is bringing in conversions, especially during that same window, I can feel good about allowing those clicks to accumulate.

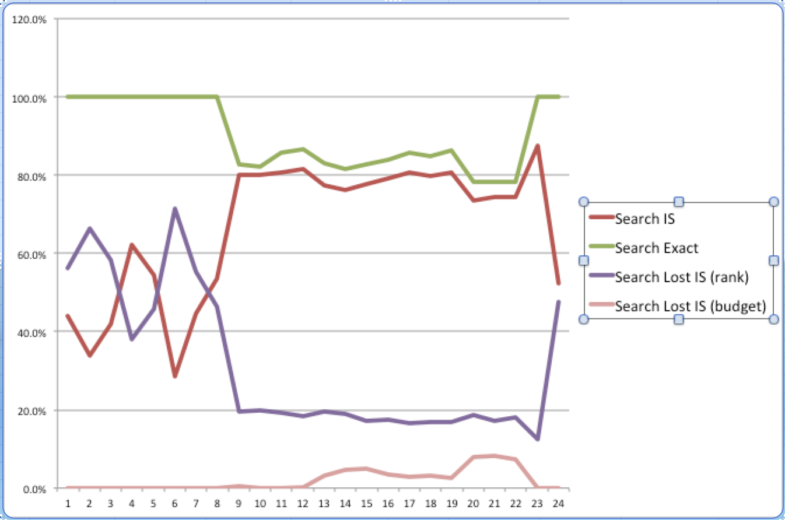

Industry share analysis: It seems that impression share metrics are a hot topic these days. And using Google’s data sets to give you more information about your hour-by-hour performance is just free insight.

For this pair of graphs, I pulled exactly the report you’re thinking: Impression-based metrics for Search, and the same for Display.

- Search IS – I’ve likened Impression Share scores to elementary school grades. Most kids who try can get a C. If you put some real effort into it, you could definitely get B’s. And if you invest some work into it, you can totally come home with A’s. The big idea here is to see when you’ve got your bases covered with your score telling you how much growing room you’ve got. I can look at this graph and feel pretty darn good about what I’m covering from during business hours and into the night. The big flag I see is between 11pm and midnight and then up to about 8am. Lots of “below average” performance. What I now need to do is compare the quality and cost of my leads during that time to the potential increase in traffic. Could I afford to spend more at this time? Does the conversion volume and rate back up this notion?

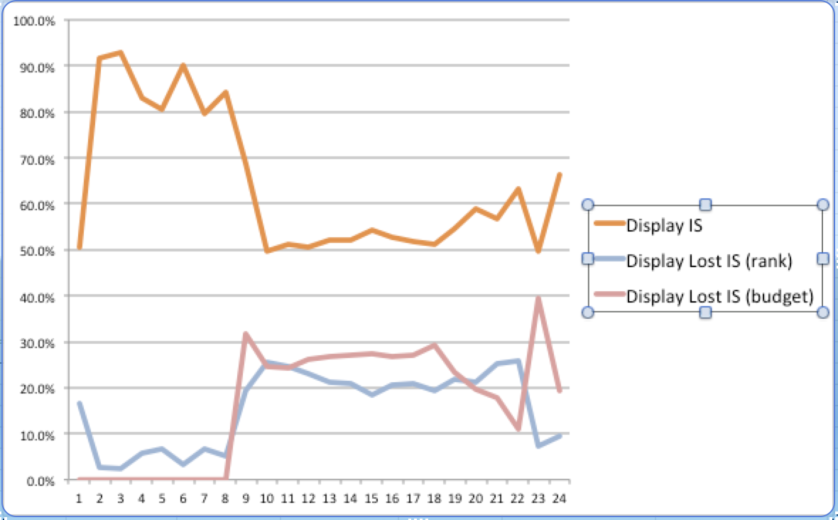

- Display IS –

What’s fascinating in this graph is how completely different it is from my search data. I can see here that I’m actually getting a fair amount of my potential display traffic during the night hours, but that during the day, during hours that I know have comparatively high conversion rates, I’ve got lots of room to expand my reach.

What’s fascinating in this graph is how completely different it is from my search data. I can see here that I’m actually getting a fair amount of my potential display traffic during the night hours, but that during the day, during hours that I know have comparatively high conversion rates, I’ve got lots of room to expand my reach. - Lost IS (rank) and Lost IS (budget)–

These twins can give me the answers to why I’m losing out on impression share. Combined they make up the yin to impression share’s yang (IS + Lost IS = 100%). Now that I know the window’s of loss I’m facing, these two metrics can give me insights into what changes may be made to improve that number.

- Rank– I can see in my graphs that when it comes to Display, around 8am I start to lose my grip on being seen by potential customers because my ads don’t rank high enough to push me into view. This may be because competitors in my industry wait till this hour to begin their daily PPC, which means every auction has that many more contenders. This means that to push through the pack I’m going to need to keep my quality score in ship shape and be willing to spend more at this point than I may have an hour or two earlier. My Search traffic sees much clearer shifts between lost IS due to rank. Again, as I examine the quality of “after hour” traffic, I may want to pursue better exposure, as I’m averaging between 40% and 70% loss due strictly to rank.

- Budget- The little pink line indicating my Search traffic presence is pretty satisfying. There are only a few hours were there’s room for improvement and they’re mostly at night. Am I concerned about this? Not at this time. What about Display? I can see that there is room to grow in my display traffic. NOTE: There is almost always room to grow in Display! There are so many combinations of targeting and keywords, placements, and audiences that there is constantly new opportunity for expansion through increased budgets.

DECISIONS BASED ON THESE DATA: Clearly from the conclusions I’ve walked through, I’m going to investigate my lost impression shares due to rank. While it’s not a ton of lost opportunity, it’s certainly a shift over times of the day. Enough so that I find myself looking into how each campaign performs at that time to see what setting I can alter. Can I allow for slightly higher bids to try for slightly better rank? I also look into what I’m missing. Are these lost impressions of value to me? I may want to add negative keywords to prevent my ads from impressing based on a less relevant search. While budgets and bids can help move me where I want to go, sometimes cutting out undesired paths can also be a real help.

So where does this leave you? With lots of ideas of how to break out your day-parting reports and where you can find opportunities to grow, shift, and optimize your accounts accordingly. Got tips of your own to share? Leave us a comment and let us know!