Editorial note: This guest post is a finalist in our Hero Conf scholarship event. Bruno Giosa is a paid search manager with Eotica in Brazil.

Lately there is a lot of talk about search funnels, how do they work, how to incorporate them and how to better use the new columns recently added by Google Adwords to understand how our keywords work along that funnel. It is not an easy task to figure this all out. And it is even harder to figure this out into a high volume campaign with more than 500k keywords.

Just to make this clear: I am an account manager working in-house for the biggest optical e-commerce in Brazil. That means we sell contact lenses, glasses and sunglasses country wide.

To understand how my search funnels work I have labeled my keywords in four categories: Awareness, Research, Decision and Purchase. This may take some time and can drive you crazy if you decide to do it all at once. I did a campaign per day to make sure I was paying attention to it and not going nuts at the same time.

Awareness would be the keywords on the search funnel top. This keywords are generic, non-branded, can contain a problem to be solved and should contain a product category. At this moment the client realizes he has a desire or necessity and started to look for a solution. Ex: sunglasses.

Research keywords are the second level on that path. They might have brand keyword but are more generic about it and do not specify the product yet. Here the client knows a bit better what he wants and starts to gather information about brand, price, colors, sizes and etc. Ex: Ray-Ban Sunglasses.

Decision keywords are located right before the purchase. These keywords contain a brand name, they are way more specific and in this moment the client already knows which brand and product they want to buy. Ex: Ray-Ban 3025.

Purchase is the last touch point in the funnel. These keywords are branded, product specific and contain a buying action keyword. At this moment the searcher knows exactly what he wants and is ready to purchase. I considered intended actions buy, order or purchase but you should also think about considering “sale”, “cheap” and etc. Ex: Buy Ray-Ban 3025, buy Ray Ban aviator 3025 or buy ray-ban.

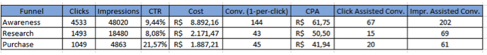

After you have labeled all those campaign keywords comes the fun part. Now, all you have to do is import that data to Excel using a decent time range and start analyzing it. This is what I have got from my campaign:

First you can see there is no Decision path in my columns and this is because the data pulled is from a Category campaign with no brand names. The purchase path include keywords with intend to buy. Now we start to analyze this data.

It is interesting to note that the Awareness phase brings me the greatest number of clicks and impressions with a decent CTR and 62% (!!!) of the conversion volume on this campaign. It might have the highest CPA but it definitely pays off when you look at the Click Assisted Conversions volume. If you are using the 80-20 method of work these are the keywords you need to keep your eyes on. Plus, now I know that I should pay more attention to this path to improve my CTR. It is likely that if I get more clicks here I will increase my conversions volume. Of course I will need to keep an eye on my CPA but it worth the risk.

The research path almost equals my CPA target to this campaign (R$48) but it fails to bring me the volume of conversions and conversion rate I expect from them. I might want to take a closer look at these keywords and try to figure out if there is something wrong with them, maybe try a different landing page. It is also intriguing to realize the low volume of clicked assists conversions coming from Research. Increasing CTR here can also be tested.

And then comes the Purchase path with the lowest volume of clicks and impressions, a great conversion rate (9.25%), CTR and CPA. This is the prime time of your account. These keywords should be treated with special care. I should try to improve the clicks coming from these keywords as much as I can.

So, tell me, have you been working with search funnels? Do they look anything like mine? What else would you suggest me doing with this campaign based on those numbers?