As pay per click professionals we’re faced with the age-old dilemma of balancing how many leads we produce for our clients vs. the quality of those leads. In many instances, we must sacrifice quality of lead in order to produce quantity and vice versa. The question that seems to come up in discussions with my colleagues is what to focus on first, quality or quantity?

Today I am going to share a case study, which proves that focusing on lead quality is the first and best way to improve business performance.

Client Background

The client offers alternatives to getting out of debt besides bankruptcy. This means that prospects have a completely different intent when typing in queries that match keywords my client bid on.

The client runs a series of Search and Google Display Network (GDN) campaigns. Search provides a low, but consistent stream of leads. Most of the GDN lead volume is driven from remarketing. Although there are non-remarketing contextual ad groups running, they tend to bring in few leads.

The cycle to convert leads to clients is generally between 60 to 90 days. Early indications of lead quality are based on

- Time from lead to close

- Client worth

- Quantity of converted leads to maintain an acceptable cost per conversion

Lead Growth Test & Results

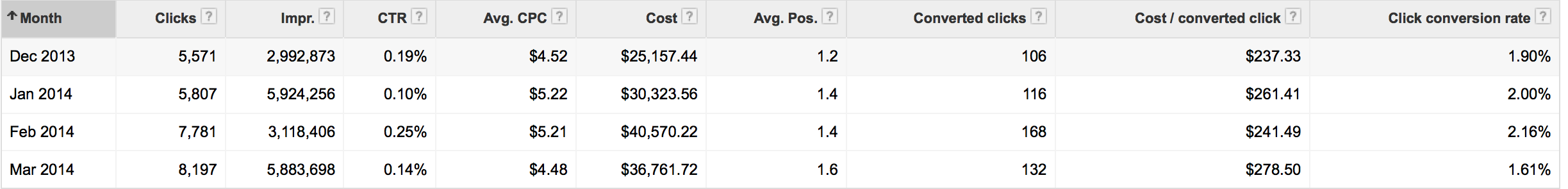

Earlier this year, it was decided to combat the plateauing search volume by placing more emphasis on GDN. Initially, the ramp up appeared to be successful in terms of increased leads while maintaining a decent standard of quality. Quality was being judged by whether or not leads were being immediately closed and although slower than normal, prospects were progressing through the sales funnel. Below is the arc of growth in GDN leads from December 2013 through March 2014.

However, it was observed that prospects progressed deep into the sales funnel but ultimately didn’t convert, or when they did finally close, the value of the client was much smaller than anticipated. The combination of lower conversion rates and low value deals made it extremely difficult to profit from GDN leads.

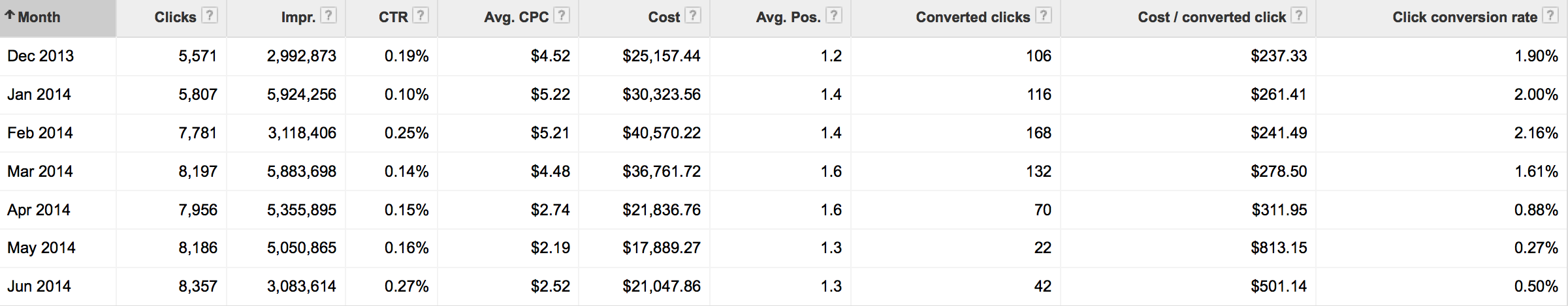

Once it became apparent that the increased GDN volume was producing leads but not clients, we did a deep dive analysis into the placement reports to understand where the conversions were originating. We learned that the GDN leads were generating many conversions, but from sites not relevant to the business, causing our client to get the wrong kind of prospect. Ultimately, the decision was made to pull back on all irrelevant sites generating conversions. The end result of this pullback was a sharp decline in lead volume. The examples below illustrate the drop in GDN leads over time and how total PPC volume was affected.

How Did We Adjust Strategy?

Once it was determined that GDN expansion wasn’t going to bring the additional quality leads the client desired, the question became how to improve lead quality and cost per deal in a stagnant search marketplace.

It took some convincing, but we sold the client on the notion that while it’s important to increase volume of leads, it’s more important to generate a higher quality lead that’s more likely to convert. This thinking was a big departure from our ‘drive the quantity’ strategy we had been working on the previous 4 months.

In order to make the new strategy work, we had to first get search CPL down. We accomplished this goal by reducing bids and pausing non-performing keywords. These keywords includes those that the client was emotionally tied to and convinced were performing well despite data to the contrary. The next thing we did was move converting keywords but at high CPLs into a special campaign where we could isolate them into their own ad groups to improve relevancy. These tactics began to drive down costs and after many months, we recently had their first week of CPL better than goal.

While working on improving search CPL costs, we worked with our client to open up a new niche they were exploring in their other marketing channels. This new niche now has a better click to lead % than the core campaigns and is currently being expanded upon.

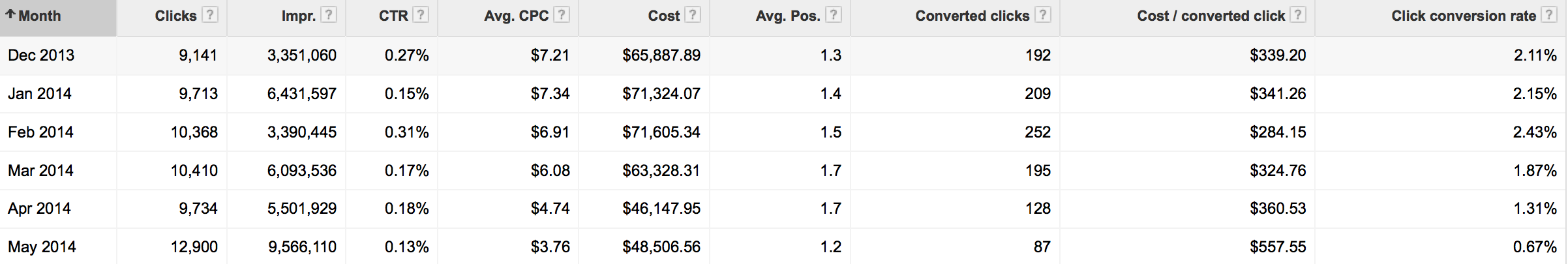

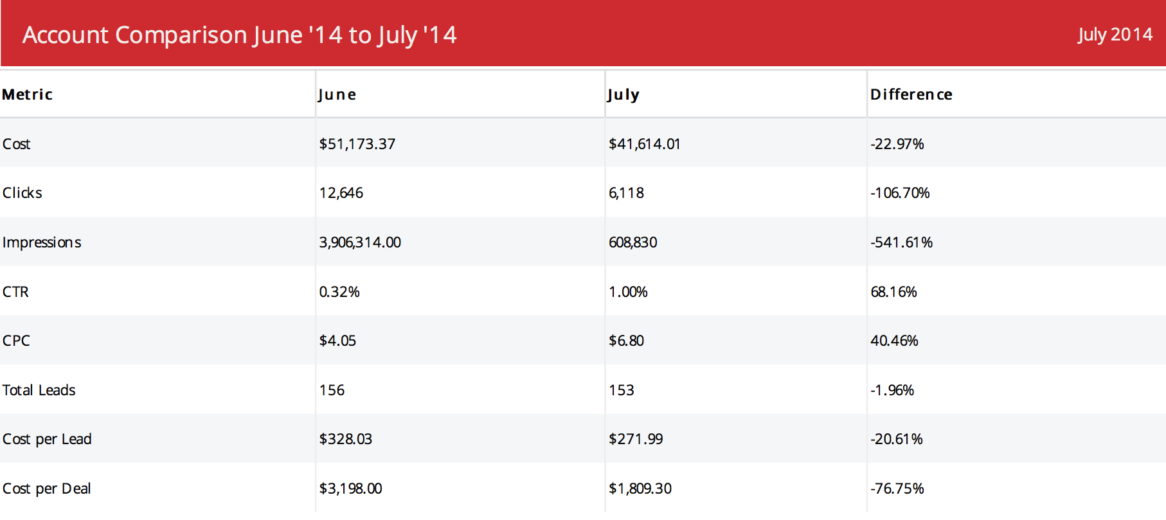

Below is data that shows the drastic month over month improvement in the client’s backend metrics (cost per deal, total clients, conversion rate, etc). While lead volume is much lower than the beginning of the year, the total amount of clients has grown and the costs to obtain those clients are much cheaper than they’ve been in years.

Conclusion

The most important item I learned throughout this process was that the quantity of leads is of secondary importance to quality of leads. The data in this case study proves that theory. Although total lead volume dropped, the amount of clients increased, the size of the deals associated with those clients has increased, and the clients are more profitable. Of course it’s important to generate as many leads as possible, but not at the expense of quality. After all, the goal is to grow business, not just the amount of leads coming though your door.