This post is shared with you from Stefan Stopper, Account Strategist at Smarter Ecommerce (@smec), and speaker at Hero Conf London.

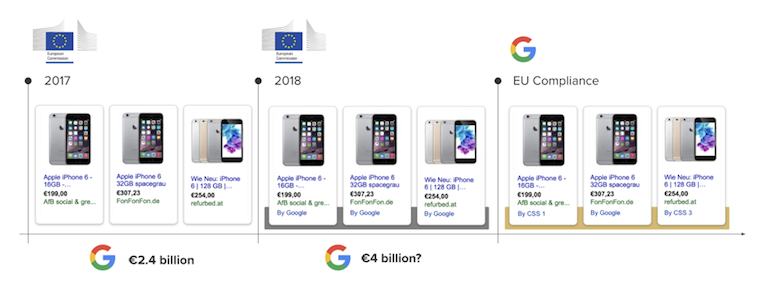

In June 2017, the EU Commission sentenced Google to pay a fine of 2.4 billion euros. Now, up to 5% of Google’s daily revenue is at stake if they fail to make their Google Shopping channel more competitive. Google is taking aggressive measures to adhere to the EU’s ruling: namely, incentivizing Comparison Shopping Services (CSS) to advertise in Google Shopping. For merchants advertising in Europe via Google Shopping, joining the auction as a CSS can yield unprecedented advantages in terms of bidding power and visibility.

Why the initial ruling?

In 2009, UK comparison shopping service Foundem initiated a complaint against Google with the EU Competition Commission. Other comparison shopping services soon joined. They accused Google of abusing its dominant search position to deny other CSS good placement on the search engine result page (SERP) and subsequently using the competitive vacuum to promote their own Google Shopping CSS system. Google’s initial response was a blog post defending their model and highlighting the fairness behind the rankings on the SERP:

“The important thing to remember is that we built Google to provide the most useful, relevant search results and ads for users. In other words, our focus is on users, not websites. Given that not every website can be at the top of the results, or even appear on the first page of our results, it’s unsurprising that some less relevant, lower quality websites will be unhappy with their ranking.”

Despite their attempts to defuse the situation, the EU Commission ruled against Google, which led to the 2.4 billion euro fine mentioned above. The Commission reserves the right to fine Google billions more if they determine that Google is non-compliant.

What does this mean for comparison shopping services and online merchants?

Google had to react fast to comply with the EU’s ruling – within 90 days. As a first step, they detached their comparison platform (known to many as the “Shopping Tab”) from the parent company within the European market: Google Shopping Europe (GSE) is now its own business unit. To prove the unit’s independence, they are obligated to operate in a demonstrably profitable manner. To prove competitiveness, they must enter the bidding auction under exactly the same conditions as other CSS providers. Together, this means Google Shopping Europe must deduct a margin percentage from every participating merchant’s bids.

Image 1: Google Shopping format changes

Simply creating a new business unit was not enough, though. Product listing ads on the SERP had to undergo cosmetic adjustments to increase transparency. An additional line of text now states which comparison shopping platform the ad is run by – which is either Google itself (“By Google”) or one of a multitude of other comparison shopping services (“By CSS x”, “By CSS y”) – see image 1. For Google Shopping users, things haven’t changed much. Google is still striving to show them the most user-relevant ads – and succeeding. Meanwhile, advertisers and comparison shopping platforms have had to face considerably bigger changes. Advertisers can now choose to run their ads via Google Shopping Europe or any other CSS – or both simultaneously, which is the approach we recommend.

What advantages do advertisers get by using CSS providers other than Google Shopping Europe?

These are still the early days of this Europe-wide market shift: CSS adoption is still quite low overall. There are strong first-mover advantages resulting the auction mechanics from advertising via both Google Shopping Europe and an alternative CSS.

Bid auction advantages

GSE has to act in a cost-effective manner: the unit is not permitted to rely on the Google parent company to absorb its operating costs or otherwise keep it afloat. Google is forced to operate with a margin per bid, currently estimated to be about 20%. At the same time, they can’t impose these profit margins upon a competitive CSS. The end result is that merchants who advertise via a CSS have the possibility to enter the Google Shopping auction at significantly lower costs, depending on their CSS provider. If the CSS provider decides not to deduct any margin whatsoever, this bid auction advantage is transferred directly to the merchant (see image 2).

Image 2: Differences in bid auction – GSE & CSS

Advertising via CSS therefore enables the advertiser to reach one of two potential goals: They can either achieve higher efficiency due to lower click prices, or a higher volume at the same cost.

Double presence on the search engine result page

Additionally, if a retailer advertises using both GSE and an alternative CSS provider, then their Google Shopping ads are able to show up twice in the same search – sometimes even right next to each other. In other words, you’re able to get double presence in the Google Shopping box. Does that mean you’re essentially competing against yourself? That’s a good question that people sometimes ask us, but the answer is clear: no. You cannot bid against yourself, because Google takes into consideration only your competitor’s highest bid (meaning the next merchant in the auction).

Should I still advertise on Google Shopping Europe?

It definitely makes sense to hold on to your existing GSE accounts. The advantage of a double presence is not to be ignored, and it gets more urgent as more merchants are jumping on the bandwagon. You do not want competitors claiming this real estate because you’re not participating. Beyond that, we are talking about a disrupted auction environment where the final legal outcomes are unknown. You should proceed rapidly, but carefully. For many merchants, this means strategically balancing the share of GSE and CSS spend in order to maximize profits.

SpendMatch ad credits

Now, this is the tricky part. Google initially offered a completely unprecedented incentive system, with up to 30% of monthly ad spend being returned to CSS-served advertisers as a “SpendMatch” ad credit within their Google Ads account. At the beginning of October, however, they announced that SpendMatch as we have come to know it will cease by the end of the month. From November 1st to December 31st 2018, there will be a fixed SpendMatch of 5% (no longer dependant on the amount of ad spend per month). At the end of the year, the SpendMatch program will shut down – maybe temporarily? We have no way of knowing at this point in time.

What else do I have to consider as a retailer?

We believe balancing CSS and GSE accounts is still the single biggest opportunity right now to see long-term profitable growth in Google Shopping, regardless of admittedly fluctuating SpendMatch incentives, so acting fast is essential. However, steer clear of making impulsive, imprudent shifts of media budget.

Our approach is to apply machine learning to this highly-disrupted bidding environment – specifically, a predictive supervised learning model. To this end, we provide an array of technical features alongside a heavy consultancy element. The combination of human and machine intelligence offers the highest yield in terms of optimization. There are big profits to be had in the CSS opportunity, but don’t rush: whoever you work with, make sure you are selecting a reliable CSS partner who wil help you pursue long-term, stable goals. Be suspicious of anyone claiming to wave a magic wand.

What will the future of Google Shopping x CSS look like?

In one possible scenario, Google may just be one out of many shopping comparison providers with dwindling presence on the SERP. Even if this solution seems like a satisfying one to those leaning against Google in the EU proceedings, it still does not fully comply with Foundem’s demand for free placement on the SERP. Also, the amount of participating comparison shopping providers has increased dramatically since the ruling and subsequent announcement of the SpendMatch system – so has the competition. As a result of Google’s actions, classic comparison shopping providers now face a variety of competitors from similar business segments but with more modern business models. Whether that intense dilution of the CSS scene is final – or intentional – is up for debate and might come under scrutiny by the EU commission once again. In any case, the Google Shopping x CSS story is definitely not over yet.