One of the first lessons you learn in PPC is the different keyword match types. They are the building block of query matching, but we don’t often evaluate them as a group. Some don’t even bother with multiple match types and sway to only using one match type or the other. They may use exact match exclusively and have extremely large keyword lists (because specificity breeds success) or give the platform the benefit of the doubt and rely exclusively on broad match (it receives the most traffic right?).

This is often a naïve approach and you should use multiple match types. Thankfully, most accounts fall somewhere in the middle of the spectrum, which brings back the question, how are the match types deployed and how do they perform? In this article, we’ll take an initial approach to the question and pull out a few interesting tidbits and ultimately add more fuel to the question fire.

The Scope Of This Article

In no way is this post in any shape or form, the end all of keyword analysis – you should be wary of anyone who promises that anyway. What we will do is take a year’s worth of a data and see what we find.

This initial post limits the keyword data to October 1, 2014 – September 30, 2015. To limit the scope, we’ll only look at AdWords data and leave Bing for another post.

For the analysis, only keywords with one or more clicks are included. Currently enabled, paused, or removed does not matter. As long as it had a click within 12 months, it is included. To keep our metrics in line, we will only focus on non-branded keywords. I’d advise you to do the same if you try something like this on your own as branded bidding can be important but heavily skews all your metrics and overshadows key data.

Finally, the data is from Hanapin Marketing’s current client roster, regardless of spend and vertical. Again, we’ll leave the client size/type breakdown for another analysis but go into this knowing that the full range of client spends is included.

My assumption is that different client types and spend levels deploy keywords in very different fashions, so beware of using this data to dictate your full tactics or strategy. Now that we’ve cleared up all that legal-sounding language, let’s jump in.

The Analysis

Before we dive into specific metrics, let’s look at how keywords are utilized in these accounts. For this first section, we’ll consider broad as being composed of both broad and broad modified. Partially because they are labeled as such but also because the two variants deserve more detailed attention, which we will arrive at shortly. Now, back to the numbers!

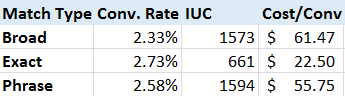

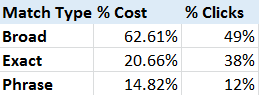

Spend across match types heavily favors broad match, with about 62.2% of total spend going to broad match. Exact match makes up 20.7% while phrase makes up a much smaller 14.8%. This is semi-expected as broad match modified has taken the place of phrase match where strict word order is less important.

There are expected swings in the other direction once we take click volume into account. By total, broad under delivers on clicks at only 49% of clicks while exact makes up 38% of clicks. Phrase is in proportion but trending under slightly.

If anything, we can comfortably say there is a higher preference for broad match and exact while phrase is used in limited cases. Interestingly enough, the total number of phrase match keywords is not too far off from regular broad match (without modifiers) but they ultimately produce a trickle of the traffic.

CTR

When it comes to CTR, exact leads the pack by a large margin with a CTR that is twice as high as the second-place broad match. Exact match is 5.53% compared to 2.73% broad match while phrase lags behind at 2.43%. This is to be expected – higher relevancy to searchers leads to higher confidence of terms on the part of the advertiser which leads to more aggressive bidding and higher SERP ranks.

Conversions

Conversion rates are much more closely aligned across the match types, ranging from 2.3% to 2.7%. Exact leads the charge again, having the benefit of higher specificity and potentially capturing later funnel leads. The largest change between match types is the impressions until conversion (IUC) which attempts to factor both CTR and conversion rate into the equation.

Because of this, exact match has a dramatically lower ratio of 661 impressions per conversion but this is primarily due to the major change in CTR, rather than the 18% higher conversion rates for exact match. We see the same factors come into play for cost/conv. Exact has a low $22.50 cost/conversion while broad has a $61.47 cost/conversion and phrase match sits at $55.75 cost/conv.

If anything, this data should lead you to step back and focus on the importance of CRO. While PPC can get you the clicks and you can optimize an account based on on-site performance and business goals, conversion rate is more closely allied with design and CRO decisions.

Once the user lands on the site, you lose control from a PPC perspective. You can steer the traffic and influence conversion rates, but they don’t rise nearly as dramatically as we saw in the CTR examples. This can be a boon for your business as a struggling PPC account can be turned around by site changes but could also go the other way as well. While not the fondest memories, I’ve seen plenty of strong performing accounts ruined by site issues. If you hope to succeed you must maximize relevant traffic through match types but also optimize your landing pages/site in order to close more deals.

Extended Analysis

Broad Versus Broad Modified

In the last section, we covered broad as an aggregate. Both broad and broad modified were counted as one match type. While technically correct, many advertisers, including myself, consider them different enough to be considered separately.

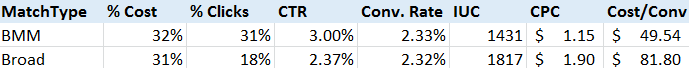

Surprisingly, broad match and broad match modified (BMM) are evenly split on the percentage of spend with 33% and 32% respectively. This is partially my own bias as I lean towards broad modified in most cases, but the original broad match is still going strong!

Both have a strong presence in percentage of spend. Once we peel back the layers, we see the two diverge again. CTR’s have a notable differentiation in favor of broad modified, leading to BMM making up 31% of the total clicks in the accounts, but broad match only making up 20%. It appears that BMM’s specificity assists here, leading to much larger click volume – a 70% higher total than broad match clicks. So while spends differ, these accounts rely more heavily on broad modified to deliver traffic.

We also see major variations in CPC. Notice the $1.15 average CPC on BMM compared to the $1.90 average CPC for standard broad match. Conversion rates are similar but the higher CTR leads to much shorter impressions until conversions and the lower CPC means drastically lower cost/conv.

That said, BMM seems to be the winner here. Before settling on one or the other, think about what you are trying to accomplish. Sometimes traditional broad match gives you the reach you need. On the other hand, these numbers could be skewed by a few larger accounts which are able to fund more aggressive tactics with traditional broad match. As they say, the numbers make sense but check it yourself as well.

Click and Conversion Rate Density

So we have all of these keywords but what do they actually do? A keyword itself can’t do anything. You can’t make traffic appear through using the right keywords. It’s all harvesting and very little creating traffic.

You can look at your active keywords and see how much of an impact your average keyword has. All things considered, most keywords have lower impact than you’d expect.

Broken down by month, the average keyword with clicks is in the single digits for clicks/month. Also remember, we only looked at keywords with clicks so it’s very likely this number is much lower once all keywords without clicks are factored in.

The same goes for conversions. Since we can’t expect a 100% conversion rate, the conv/keyword ratio is much lower than the click/keyword ratio. Even exact match only tops out at 1.55 conversions per keyword, and that is over a year.

This isn’t to say these keywords don’t do anything. You should clearly target long tail terms where you can. What this does tell you, though, is that if you miss a keyword, it won’t be the end of the world and the impact is marginal at best. You are better off focusing on your key terms than continually expanding or worrying about reviewing every single term in the account.

Word Count Distribution

Does the word count matter? The most obvious answer is “it depends.” Word count will vary based on service, product, or any sort of name. Some products have three words in the title, some have five. The question is then, do we as account managers prefer shorter or longer keywords? Similarly, for exact match, do searchers prefer longer or shorter queries?

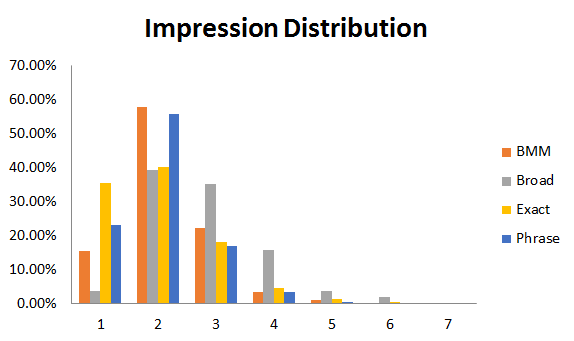

According to the charts, about 43-45%, depending on match type, of keywords are made up of three words. We see strong showings at two and four, but precipitous drops once we move further out. Interestingly the pattern holds for all match types.

Perhaps both advertisers and searchers prefer shorter terms. Not to mention the traffic harvesting aspect requires advertisers to adapt to user behavior, reinforcing the trend. If anything, you should lean towards using shorter keywords. Heavy implementation of long keywords won’t get you far.

Once we factor in impressions, we see the distribution shift to the left. Notice how exact match in particular really shines when it comes to short terms. Maybe it is the terms themselves, maybe users are actually leaning towards quicker searches and putting their faith in the search engine to deliver them to the right pages. Either way, short keywords are leading the charge.

What Comes Next?

We’ve discovered a few pieces of data on match type performance, but there are many more questions to ask. One of the key unanswered questions is, “assuming you use the same keyword text, what is the real difference in match type performance?” It fell outside the scope of this article but is an important second level question.

Secondly, does this data vary based on vertical or account type, lead gen or e-commerce? Each type of account will have its own preferences for reach and targeting.

Both of these questions add further nuance to the data and help adjust our expectations as there are surely many of them in the points raised above. That is what keeps paid search interesting. As we wrap up, have you done a similar analysis and how did your findings line up with this article? Feel free to leave any comments or links in the comments and provide other readers with further rabbit holes to dive into!